For younger generations, the challenge of owning a home is so ubiquitous it’s become a hackneyed punchline. “This and never owning a home” is meme text overlaid on a photograph of a pilates studio. While boomers have blamed the Millennials’ financial hardships on an insatiable desire for avocado toast, the obstacles are not as cut and dry. Faced with skyrocketing home prices, financial literacy gaps, and the widening wealth divide with older generations, younger buyers must navigate an increasingly complex real estate landscape. Unsurprisingly, the biggest hurdle for all first-time homeowners is saving for a down payment, with 31% of Gen Z and 37% of Millennials citing it as the biggest challenge. Despite these setbacks and the general memeified fatalism, Millennials and Gen Z are in fact entering the housing market. As first-time homeowners, how are younger generations navigating this unchartered financial landscape?

It may come as a surprise that Gen Z is actually buying homes at a slightly faster rate than Millennials, driven by rising costs and the fear of being priced out. To make homeownership more affordable, many young buyers are turning to co-ownership, with 22% choosing to split costs with a partner, friend, or family member. Meanwhile, according to census data and private surveys, Millennials are leaving pricey cities like New York, Chicago, and D.C. in search of more affordable places to live, while Gen Z is gravitating toward cities like Washington, D.C., Columbia, SC, and Boston. With homeownership bringing unexpected maintenance costs and logistical challenges, young urban professionals are increasingly turning to platforms like Taskrabbit as a flexible and affordable way to manage the bottomless to-do list of home ownership. As younger generations reshape the housing market, Taskrabbit can help bridge the gap between aspiration and reality, helping first-time homeowners navigate their obstacles with confidence.

Taskrabbit conducted a widespread survey* of first-time homeowners to bring you a comprehensive guide on what to expect as a first-time home owner:

Unexpected Homeownership Costs

Homeownership comes with an array of unexpected challenges, and generations seem to feel the pressure in different areas of their life. Here are the top expenses that come as a jump scare to most first-time homeowners.

- Property Taxes:

- Gen Z: 33%

- Millennials: 31%

- Utility Bills:

- Gen Z: 32%

- Millennials: 25%

- Regular Home Maintenance (HVAC, Plumbing, Appliances):

- Gen Z: 30%

- Millennials: 32%

- Lawn Care:

- Gen Z: 19%

- Millennials: 9%

For those looking to tackle these responsibilities, Taskrabbit offers a great solution, with skilled Taskers for everything from routine maintenance to emergency repairs. By scheduling tasks and hiring help, you can reduce stress and avoid expensive mistakes.

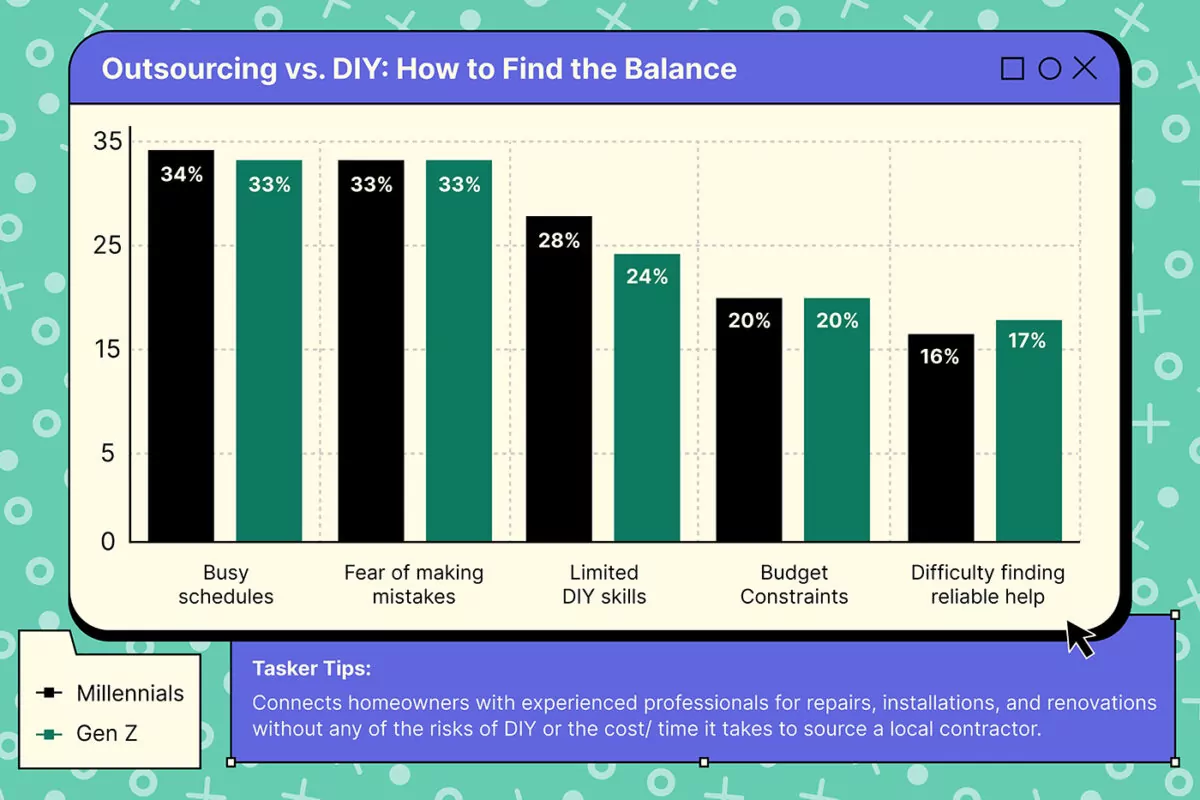

Outsourcing vs. DIY: Striking a Balance

Finding the right balance between outsourcing and DIY can be challenging, but understanding why people outsource their housework can help. Here’s a look at the main reasons homeowners say they opt for outsourcing chores:

- Busy Schedules:

- Gen Z: 33%

- Millennials: 34%

- Fear of Making Mistakes:

- Gen Z: 33%

- Millennials: 33%

- Limited DIY Skills:

- Gen Z: 24%

- Millennials: 28%

- Budget Constraints

- Gen Z: 20%

- Millennials: 20%

- Difficulty finding reliable contractors or professionals

- Gen Z: 17%

- Millennials: 16%

For those looking to avoid the stress and risk of DIY, Taskrabbit connects homeowners with experienced local Taskers for repairs, installations, and renovations.

Budgeting for Home Projects, Repairs & Upkeep

Understanding spending habits can help you budget your home projects strategically. Here’s a breakdown of what Gen Z and Millennials typically spend to maintain their homes and the hours they devote to the job:

- Annual Spend on Home Projects:

- Gen Z: 38% spend $5,000–$10,000

- Millennials: 36% spend $5,000–$10,000

- Investment in Larger Improvements ($10,000–$25,000):

- Gen Z: 28%

- Millennials: 22%

- Budget-Conscious Home Projects Under $5,000:

- Gen Z: 25%

- Millennials: 34%

- Monthly Time Spent on Maintenance:

- 5-10 Hours Per Month on Home Maintenance:

- Gen Z: 50%

- Millennials: 40%

- 11-20 Hours Per Month on Home Maintenance:

- Millennials: 26%

- Gen Z: 18%

- Less Than 5 Hours Per Month on Home Maintenance:

- Gen Z: 18%

- Millennials: 22%

- 5-10 Hours Per Month on Home Maintenance:

These differences may be due to factors like Millennials working more from home, which gives them more flexibility to handle chores. Alternatively, Gen Zers tend to live in smaller spaces that require less routine maintenance. For those looking to keep costs down and save time, Taskrabbit offers cost-effective solutions that help you stay on budget while freeing up your valuable time.

*Survey conducted via consumer research platform, Attest.